prince william county real estate tax due dates

Prince william county collects very high property taxes and is among the top 25 of counties in the united states ranked by property tax collections. Deadline for Filing Declaration of Tangible Personal Property if required Commissioner of the Revenues Office April 15.

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

During the July 14 meeting the Prince William Board of County Supervisors voted to defer payments for the first half of the real estate taxes due on July 15 2020 until Oct.

. Real Estate Tax 2nd half of Fiscal Year Stormwater Fee. State Income Taxes and State Estimated Taxes. Tax Relief for the Elderly and Disabled Mobile Homes Application Due Date.

Then they multiply that by the tax rate to get your property tax. Prince William County collects on average 09 of a propertys assessed fair market value as property tax. If you have questions about the real estate assessment process please contact the Real Estate Assessments Office at 703-792-6780 or email protected.

Restaurants In Erie County Lawsuit. Prince william county real estate tax due dates. 12 Oct 20 Subscribers of Prince William County in General.

Visit httpsbitly34OzgtF to learn more. State Estimated Taxes Due Voucher 1 June 5. Northern Virginia Residential Property Tax Rates And.

Payment by e-check is a free service. Deadline for Purchasing Kennel Tags Treasurers Office March 5. Personal Property Tax Vehicle License Fee.

Personal property tax bills are mailed late summer with payment due October 5 unless this date falls on a weekend or holiday. A convenience fee is added to payments by credit or debit card. The Prince William Board of County Supervisors deferred the first half of the real estate tax due date for unpaid taxes to tomorrow October 13.

Are Dental Implants Tax Deductible In Ireland. Board Extends Due Date for Real Estate Taxes. Estimated Tax Payment 4 Due Treasurers Office January 31.

Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Prince William County Real Estate Assessor 4379 Ridgewood Center Drive Suite 203 Prince William VA 22192 Prince William County Assessor Phone Number 703 792-6780 Prince. Due to the low tax rate.

00001 per 100 of assessed value for property tax classifications listed below no tax bills are generated if the assessed value is 50000000 or less. Hi the county assesses a land value and an improvements value to get a total value. Every taxpayers levy.

Other public information available at the real estate assessments office includes sale prices and dates legal descriptions descriptions of the land and buildings and ownership information. You will need to create an account or login. All you need is your tax account number and your checkbook or credit card.

ITEMS SUBJECT TO THE PERSONAL PROPERTY TAX. To help businesses impacted by the economic impact of COVID-19 the County has extended the Business Tangible Personal BTP Property tax filing deadline from April 15 2021 to May 17 2021. Then they get the assessed value by multiplying the percent of total value assesed currently 100.

Prince William property owners will get a three-month extension on their real estate tax bills as a result of action the board of county supervisors took Tuesday. Report changes for individual accounts. Restaurants In Matthews Nc That Deliver.

What is the property tax rate in Prince William County VA. The board took the action to provide relief to county businesses and residents affected by the COVID-19 pandemic. By mail to po.

What is different for each county and state is the property tax rate. How will i recieve my pets license and annual renewal notice. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

Prince William County real estate taxes for the first half of 2020 are due on July 15 2020. Majestic Life Church Service Times. In Prince William County Virginia the tax rate is 105 which is.

Opry Mills Breakfast Restaurants. Prince William County Real Estate Tax Rate. Report a Change of Address.

Citizens and businesses struggling to pay real estate taxes during the coronavirus pandemic will have a payment extension to October 15 2020 due to a decision from the Prince William County. First Half Real Estate Taxes Due Treasurers Office June 15. Make a Quick Payment.

How property tax calculated in pwc. Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the 3143 counties in order of. When are property taxes due in Virginia County Prince William.

With due diligence examine your tax levy for all other possible errors. The board voted unanimously to defer payments for the first half of annual real estate taxes originally due today July 15 -- until Oct. Business License Renewals Due.

During the July 14 meeting the Prince William Board of County Supervisors voted to defer payments for the first half of the real estate taxes due on July 15 2020 until Oct. In Prince William County a personal property tax is assessed annually as of January 1 on automobiles trucks motorcycles trailers and mobile homes. State Income Tax Filing Deadline.

Personal Property Taxes Due. Tax Relief for Elderly Renewal Due Commissioner of the Revenues Office April 15. Learn all about Prince William County real estate tax.

The real estate tax is paid in two annual installments as shown on the tax calendar. The due date for 2nd half 2021 real estate taxes is december 6 2021.

Where Residents Pay More In Taxes In Northern Va Wtop News

Prince William Supervisors Finalize Fiscal 2023 Spending Plan Headlines Insidenova Com

2022 Best Places To Live In Prince William County Va Niche

Prince William Times Home Facebook

According To The Realtor Association Of Prince William A Total Of 827 Homes Were Sold In August 2020 An I Prince William County Prince William Housing Market

How Healthy Is Prince William County Virginia Us News Healthiest Communities

Class Specifications Sorted By Classtitle Ascending Prince William County

Prince William County Va News Wtop News

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Good Map Of The Counties Surrounding Fairfax County Arlington County Loudon County And Prince William Fauquier County Fairfax Virginia Prince George S County

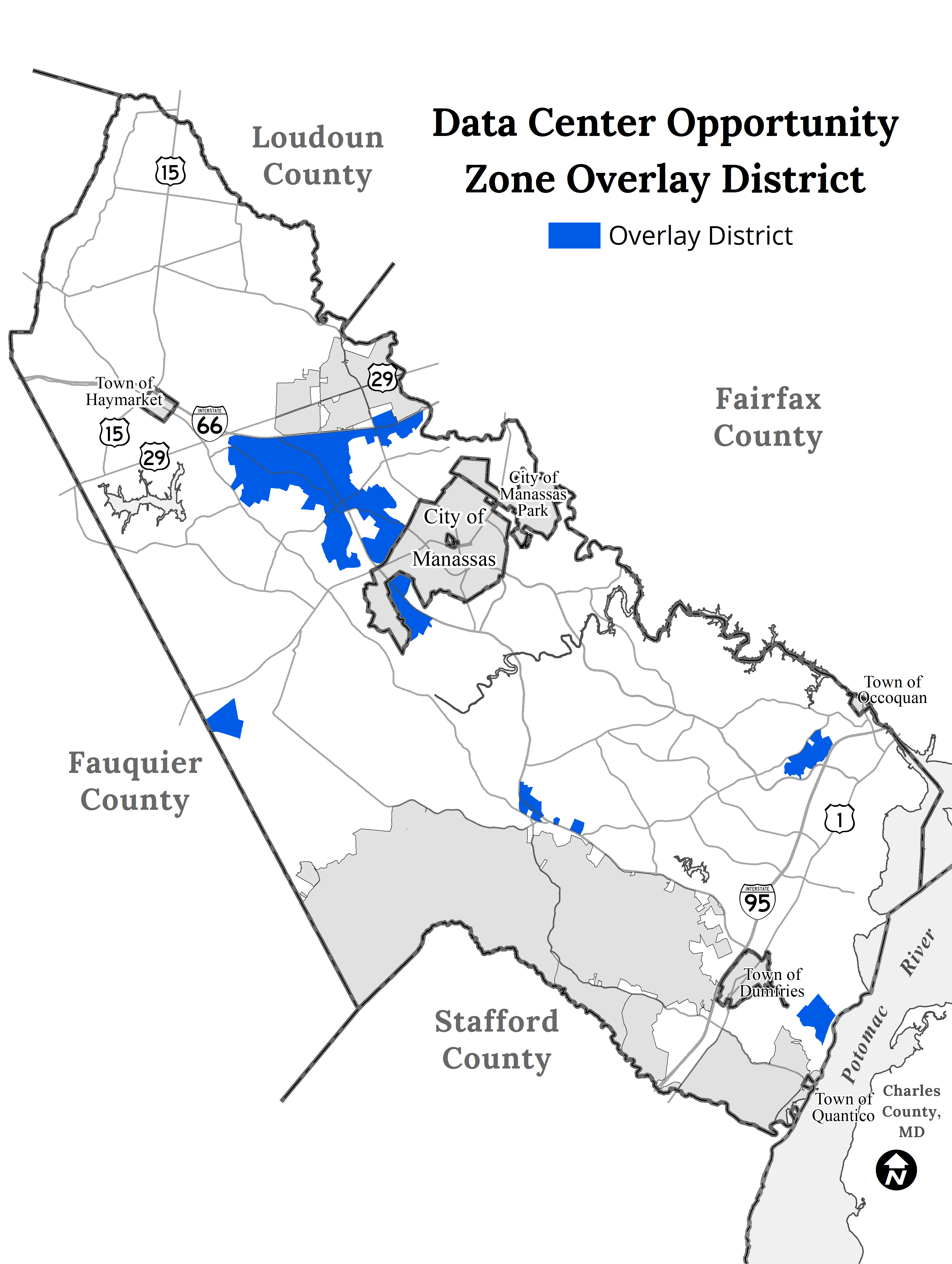

Fairfax County Officials Ask Prince William County To Reconsider Pw Digital Gateway Proposals Dcd

.jpg)